Annual Check-up Part II (the sequel)

In my last entry, I discussed the need to perform a periodic financial check-up of your credit union to see how it is doing. The check-up here take on two phases. First, we need to make sure nothing horribly wrong is occurring in the institution. For instance when you go to the doctor’s office your vital signs are taken and compared to the past and the norms for your age and weight. If your blood pressure is high and increasing, then you could be running the risk of cardio-vascular disease or stroke. In the last entry, and this entry, we are looking at ratios listed by the NCUA as things they consider for basic safety and soundness of the institution, and since they are a regulator with power to pull the plug on the credit union, their opinion matters. Many of these ratios are in fact good measures of important health related concepts for your institution, and worth our time discussing.

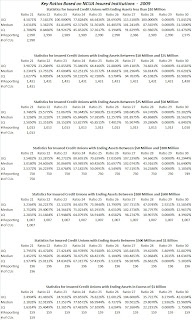

In addition to the general discussion, the reader is again referred to the NCUA list, which uses account numbers from call reports for easier identification[i]. In addition, industry norms for NCUA insured credit unions are provided by me in the margins. The interested reader is referred to the earlier blog entry for explanation of upper quartile, median, and lower quartile. In the last installment, we discussed the CAMEL method of analysis, described in a somewhat dated, but largely still valid NCUA document[ii]. Using the understanding from these documents, it for managers and board members to pre-assess their institutions for compliance with the NCUA’s CAMEL rating system. With the CAMEL system as a background, the ratios presented last week and this week can be brought into sharper focus. Note that the NCUA list is broken up into categories along the side. Four of the five letters in CAMEL: Capital adequacy (ratios 1-4), Asset quality (ratios 5-9), Earnings (ratios 10-21), and asset/Liability management (ratios 22-29). The M in CAMEL is the only one missing. Read the above noted documents to understand how management is assessed by NCUA. The first ten ratio were covered in the last blog entry. We therefore, will continue from there:

|

| Ratios 11-20 2008 |

Ratio 11: Gross Income over Average Assets – This ratio is poorly named if you are familiar with financial ratios from any other industry. To NCUA, gross income represents revenue only from all sources (interest income, non-interest income, income from other source). This ratio is more closely akin to the inverse of the total asset turnover ratio in manufacturing. In its current format, the higher this figure, the better. But the interpretation needs some adjustments from the analyst, since the only place we can get higher revenue is primarily from our member/owners, we can’t simply increase the price (even at times when the market will bear), because that may not best serve them. The point of this ratio is that we wish to measure how efficiently we are using our assets, so we should focus our attention on the denominator of the ratio if this figure is too low. Only after such consideration, should we consider increasing revenue through pricing reform.

Ratio 12: Yield on Average Loans – This ratio seeks to measure the annual yield on the average loan balance. If the institution were a bank, we would unambiguously want this figure to be as high as possible. But credit unions exist to improve the financial situation of their owners/members. And those same members wish to pay lower loan rates. All academic research methods acknowledge that fact – all that is, but those few (and getting fewer) that use ROA to measure performance. We will try to pull these together next blog entry.

Ratio 13: Yield on Average Investments – Like ratio 12, this ratio seeks to measure the annual yield on average investments. This figure should be unambiguously as high as possible. At financial institutions, these investments tend to be US Treasury bills and bonds, which is why there is not much variance in this figure across institutions.

|

| Ratios 11-20 2009 |

Ratio 14: Cost of Funds over Average Assets – This figure is the cost figure companion to ratio 11. It scales annual borrowing cost, as well as costs of share deposits, and dividends by average assets. If the credit union were a profit making endeavor, this figure should be unambiguously small. However, since many of these sources are the only payments to my owners, one might think it should be as large as possible, but since borrowings are included that could not also be the goal. Borrowings are debt to outside parties, such as large banks. Larger credit unions may have to raise some money here, but it is usually more expensive than payments to owners in the form of deposits/dividends. Since NCUA is interested in how well the institution is growing their equity with their assets, they act as if the credit union should be interested in decreasing this ratio, and at the same time increasing gross income on average assets (ratio 11). This ratio may not be as useful to boards of directors and managers.

Ratio 15: Net Margin over Average Assets – This ratio is literally gross income on average assets (ratio 11) minus cost of funds over average assets (ratio 14). NCUA will want this figure to be as high as possible, because it will generate equity, and make them sleep better. However, it will not necessarily be in the best interest of the credit union’s owners (see discussion in the description of those two ratios above).

|

| Ratios 11-20 2010 |

Ratio 16: Operating Expense over Average Assets – This ratio simply scales total annual non-interest expense by average assets. In general, both NCUA and owners/members would want this figure to be as low as possible, since it represents costs paid outside the institution. If the expense is associated with a valued service, there may not be much the institution is willing to do about it, but the owners must understand a trade-off exists between cost of services and loan/deposit rate concessions.

Ratio 17: Provision for Loan and Lease Losses over Average Assets – This ratio scales the accounting annual provision for loan losses and lease losses by average assets. The scaling by average assets is a way of comparing a revenue or expense level to different institution size. The reason the numerator is called a provision is because the loss has not yet occurred, but is the best estimate of losses based on experience at this institution and the current delinquency rates. Obviously, both NCUA and members want this figure to be as low as possible. They should also want the provision to be as accurate as possible.

Ratio 18: Net Interest Margin – This ratio takes the numerator from yield on average loans (ratio 12) plus the numerator from yield on investments (ratio 13) minus the numerator from cost of funds to average assets (ratio 14), and scales it all by average assets. In essence it seeks to measure the amount of money thrown off from loans and investments, net of borrowing, deposits, and dividends, all scaled by how many assets the credit union has. The NCUA would like this to be as large as possible. For practical purposes, members/owners should want this figure to be high enough to maintain the net worth to total assets ratio at or above a level specified by the board as being high enough not to get in trouble with NCUA. But they are also interested in high yielding deposits, and low cost loans.

|

| Ratios 21-30 2008 |

Ratio 19: Operating Expense over Gross Income – This ratio could be calculated by taking the operating expense over average assets (ratio 16) and dividing it by gross margin over average assets (ratio 11). This ratio measures the proportion that non-interest income is of total revenue. The lower this ratio is, the better – for both NCUA and credit union members/owners (with the exception as noted in ratio 16).

Ratio 20: Fixed Assets Including Foreclosed and Repossessed Assets over Total Assets – This is probably the longest name for a ratio in the NCUA’s list of ratios. The reason this ratio is interesting is that it is looking at assets that are non-productive. When scaled by total assets it looks at the percent of total assets that can’t really bring in earnings by themselves. This ratio is also inspired by a banking mentality of maximizing profits. There is some evidence by looking at the German banking system to suggest that members may demand more branches from their cooperative banks than commercial banks[iii], which implies that they would prefer higher levels of service than simply higher deposit rates and lower loan rates. Although the NCUA would like this ratio to be lower, from the individual institution’s perspective, this may be an area where the board of directors needs to inform management what is demanded by the membership.

|

| Ratios 21-30 2009 |

Ratio 21: Net Operating Assets over Average Assets – Since non-interest expense is almost always larger than non-interest income, this ratio looks at fee expense minus fee income and scales it by the average size of the institution. This is one of those ratios that probably is looked at differently by the NCUA and the board of directors of the credit union. Yes, the credit union does have to make enough money to maintain sufficient capital in the form of net worth, but members may opt to take part of their return in lower cost of service. This is a ratio that should be understood by the board, and then inform management whether this is an issue (as long as it is not so bad that NCUA will have issues). NCUA again will want this to be as low as possible. And if the members want more services, they must give up more in the way of deposit/loan rate concessions.

Ratio 22: Net Long Term Assets to Total Assets – This is the first under the heading of asset/Liability management ratios. This ratio has such a long numerator, it is hard to get what it is doing. It is particularly difficult if you try to calculate since for the years presented here (the most recent three years) some accounts have changed their names slightly. If you follow the NCUA list, you will need to use both 799C1 plus 799C2 for what the NCUA listed as simply 799C. This ratio is a proportion. It measures the proportion that net long term assets are of total assets (obviously). By net long term assets it means both earning assets and non-earning assets (loans, investments, fixed assets, and even the NCUA insurance capitalization deposit), net of non-funded commitments, and double counting. The term long term is not the same as it might be in other financial contexts. In most accounting and finance contexts, long-term means greater than one year before the asset turns to cash. In the case of investments, only those with maturities greater than three years are included in this ratio. Excluded from real estate loans are those which finance, reprice or mature within five years. The imprecision in this measure should qualify it as an estimate, rather than a true ratio. Because earning and non-earning assets are included, interpretation is even more difficult. In general, NCUA would likely use this ratio to assess what proportion of your assets cannot adjust to interest rate fluctuations. But it is problematic, since non-earning assets are in there, which can’t ever adjust their yield.

|

| Ratios 21-30 2010 |

Ratio 23: Regular Shares to Total Shares and Borrowing – This ratio is a little more sensible. It measures the proportion regular deposit accounts from members are as a total of all shares, and borrowings less borrowing repurchase transactions placed in investments for purposes of positive arbitrage. The reason this is an interesting ratio is that it measures the proportion of total sources of asset funding that is both longer-term and inexpensive. As long as members are happy with their deposit choices, then the larger this proportion the better for both NCUA and members/owners. However, if this ratio is above the upper quartile, the board may ask whether members might not be aware of other deposit choices that might improve their return.

Ratio 24: Total Loans to Total Shares – This ratio is very interesting. The highest yielding asset is generally loans. The least expensive liability is shares. Even in credit unions where an attempt is made to reduce loan rates to benefit borrowers, and increase dividends/interest paid on deposits, these same principles hold. So the more the credit union has productively invested in loans as a percent of shares the better for both NCUA and the member. The higher this ratio, therefore, the better.

Ratio 25: Total Loans to Total Assets – This ratio is an extension of the last discussion. The higher the proportion of high earning, productive assets the better from the perspective of the NCUA and member.

Ratio 26: Cash and Short Term Investments to Assets – This is a measure of financial liquidity. Financial liquidity is the ability to quickly turn assets to cash without loss of market value. Both cash and short term investments (usually financial institutions hold only highly marketable investments, such as US Treasury bills, as short term investments). Viewing the institution from the NCUA’s perspective of not wanting it to run out of cash if needed, the higher this figure the better. However, from an owner’s perspective, one must balance the need for sufficient liquidity with that of sensibility. Short-term assets don’t really benefit the owner very much. They certainly don’t earn very high returns, nor does cash for that matter. Although it is nice to have cash when members need it, there are ways to manage the need for cash and the need for more sensible returns (which if loans are made to members also benefit them). This ratio should usually be in the inter-quartile range (between the upper and lower quartiles) from a member’s/owner’s perspective.

|

| Ratios 31-40 2008 |

Ratio 27: Total Shares, Deposits, and Borrowings over Earning Assets – This ratio measures pretty much what it says. The numerator contains all sources of funds that cost the credit union money. The denominator contains those assets that earn money (both long and short term). Regardless of who is checking this ratio, all will want this ratio to be as small as possible. It is easier to pay depositors and lenders when you are making money from your assets.

Ratio 28: Regular Shares and Share Drafts over Total Shares and Borrowings – This ratio measures the proportion of sources of funds that cost the credit union the least amount of money to all sources of funds that cost the credit union money. From an earnings maximization model, the NCUA might want this ratio to be as high as possible. Again if the member is happy with their deposit choice from a return/accessibility standpoint they also would want this ratio to be as large as possible. From a practical standpoint, the board might want to market more appropriate choices if this ratio is above the upper quartile, just to be sure that member’s deposit choice are not from ignorance.

Ratio 29: Borrowings over Total Shares and Net Worth – This ratio seeks to measure the proportion of sources of funds that are supplied by borrowings. Since borrowings are typically the most expensive source of funds, the lower this ratio is the better.

Ratio 30: Members to Potential Members – This is the first ratio not used to assess the CAMEL rating. This ratio is listed as a productivity ratio. This ratio is actually a market penetration ratio. It measures what proportion of potential members are actually members. This is an interesting ratio to see, and compare your credit union to the industry norms. If you are outside the normal range (upper to lower quartile) that may have as much to do with the definition being used of the potential market as it does with reality. But if your institution is significantly low, you might want to explore reasons why you might not be attracting the potential members you could.

|

| Ratios 31-40 2009 |

Ratio 31: Borrowers to Members – This ratio measures what proportion of members who are also borrowers. This may be important in setting loan rates. Credit union theory suggests that the boards of directors set the policy for loan and deposit rates depending on the perceived wishes (as a financial economist I want to say utility function) of the members. There is a set of ratios in this section which might make this split easier. In addition to the proportion of member borrowing from the institution, the sensitivity of loan and deposit rates tends to change over time, and to some extent these rates are also dependent on market forces. Boards of directors also need to be sensitive to those market realities.

Ratio 32: Members to Full-time Employee – This ratio measures the number of members served by full-time equivalent employees. If you are looking for ultimate efficiency, then this number should be as high as possible. However, in a cooperative, members may opt for more service and less efficiency. The cost of that higher level of service would come from lower deposit rates and/or higher loan rates. There is a natural tradeoff. Again the optimal level for this ratio is a function of the preferences of the members. And therefore the board of directors is uniquely qualified to give management input on this important issue.

Ratio 33: Average Shares per Member – This ratio measures exactly what it says, how large a deposit does the average member have. It should be noted that this figure is slightly miscalculated since the shares figure used in this ratio includes non-member deposits. This is another ratio that could aid boards of directors in finding out how to set deposit/loan rate policies that would be palatable to current members. Together with the next ratio and where the credit union falls in the industry norm, could go a long way to help make the decision which way they should go with those rates.

Ratio 34: Average Loan Balance – This ratio measures the average loan balance per member. With the earlier discussions in ratios 31 and 33, there has been sufficiently said about this ratio and how it could be used.

|

| Ratios 31-40 2010 |

Ratio 35: Salary and Benefits per Full Time (Equivalent) Employee – Okay I added the “equivalent” portion. But they again make an adjustment for part-time workers. In general, it would be nice to have this as low as possible. However, salary and benefit costs must be weighed against their impact on quality service. Again, the board of directors can give their advice as to the trade-off between deposit and loan rates and quality service, as well as their perception of how salary and benefits impact that service quality. That having been said, it would be a little hard to make a case for a credit union that is well outside the industry norms (in either direction).

Ratio 36: Net Worth Growth – These last set of five ratios could be seen as ways of seeing whether your credit union is growing at a balanced rate. The most important component in this growth is net worth. If the net worth is not growing at least as fast as assets, then your credit union may fall below the safe level established by NCUA, and may be in danger of being shut down. Although industry norms exist for this ratio, it is more important to compare this number to the asset growth ratio (ratio 39). Oh, the denominator in this one is crazy, since it makes you take the absolute value of last year’s net worth. I can’t imagine NCUA allowing a credit union to be around for a year with negative net worth.

Ratio 37: Market (Share) Growth – This is an unfortunate name. It measures the percent change in shares (deposits). The name implies (at least to me) that it is looking at market share. Since shares (deposits) benefit members directly, and cost less than other sources of funds, it is in the best interest of the credit union to grow these as fast as, or faster than, assets. When institutions grow extremely fast, however, they sometimes have to rely more on borrowings to make up for some sources of funds.

Ratio 38: Loan Growth – This ratio measures the percent change in loans. Since loans directly benefit members, and since they yield more in return when productively employed as earning loans than any other use, this ratio should also optimally grow as fast as assets. But the quality should be closely monitored if they grow abnormally fast (compared to the industry norms).

Ratio 39: Asset Growth – This ratio measures how fast assets have grown in the year. This is the real benchmark against which all other growth rates should be held.

Ratio 40: Investment Growth – This ratio measures how fast investments have grown in the year. This ratio could help you see if funds are being moved from loans to investments or vice versa over time. There is a reason why it is listed last. It is not likely to be more help than that.

[i] To find the numbers for the ratios, follow the link indicated in the text. Then use the tab at the top labeled “Call Report” or the button along the side with the same label. Once in the call report for the year you want, click on the label on the side entitled “View All Pages”, then I would use the find button on your browser (Ctrl-F) to find the account number you are looking for.

[ii] A partial update was made in 2003 or 2004, but it does not include as good of a discussion of how CAMEL ratios are used in the process.

[iii] This statement must be modified for application to US credit unions because German cooperative banks pay income tax, whereas credit unions don’t. Adding more services in German cooperative banks allows the bank to pay back to the members before taxes. This is clearly what would happen in the United States if credit unions were taxed.

Comments

Post a Comment